See the rates applicable to each income bracket in Table 1. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained.

How To Calculate Income Tax In Excel

On the First 5000 Next 15000.

. New Malaysia Personal Income Tax Rates 2016 Assessment Year 2015. Income Tax Rates and Thresholds Annual Tax Rate. Individual Life Cycle.

Introduction Individual Income Tax. Find Out Which Taxable Income Band You Are In. Calculations RM Rate TaxRM 0-2500.

Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income. It also included increases in the child tax credit.

On the First 2500. Malaysia Non-Residents Income Tax Tables in 2019. Tax Rates for Individual.

Calculations RM Rate Tax RM 0 - 5000. Resident companies are taxed at the rate of 25 reduced to 24 wef YA 2016 while those with paid-up capital of RM25 million or less are taxed at the following scale rates. Income tax rates for resident individuals whose chargeable income from RM600001 to RM1000000 be increased by 1 from 25 to 26 and chargeable income exceeding RM1000000 be increased by 3 from 25 to 28 from.

Assessment Year 2016 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income. Individual Income Tax Returns 2016 Individual Income Tax Rates 2016 28 Act of 2003 JGTRRA. Below are the IndividualPersonal income tax rates for the Year of Assessment 2013 and 2014 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia.

Wef YA 2016 tax rates for resident individuals whose chargeable income from RM600001 to RM1000000 be increased by 1 and chargeable income exceeding RM1000000 increased by 3. Malaysia Income Tax Rate for Individual Tax Payers Lowest Individual Tax Rate is 2 and Highest Rate is 26 for 2014 and Lowest Tax Rate for Year 2015 is 1 and Highest Rate is 25 Non-residents are subject to withholding taxes on certain types of income. 25 percent 24 percent from year of assessment ya 2016 special tax rates apply for companies resident in malaysia with an ordinary paid-up share capital of myr 25 million and below at the beginning of the basis period for a year of assessment provided not more than 50 percent of the ordinary paid- up share capital of the company is.

Malaysia Personal Income Tax Rates Table 2017 Updates Budget Business News. No guide to income tax will be complete without a list of tax reliefs. YA 2016 onwards Changes to Tax Relieves.

New Malaysia Personal Income Tax Rates 2016 Assessment Year 2015 Resident Individual tax rates for Assessment Year 2013 and 2014. CORPORATE INCOME TAX 12 Chargeable Income YA 2015 YA 2016 The first RM500000 20 19 In excess of RM500000 25 24. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region.

The below reliefs are what you need to subtract from your income to determine your chargeable income. Other income is taxed at a rate of 26 for 2014 and 25 for 2015. On the First 5000.

Regarding expatriates who qualify for tax residency Malaysia has a progressive personal income tax system in which the tax rate increases as an individuals income increases starting at 0 and being capped at 25 before the assessment year of 2016 and 28 from 2016 onward. Chargeable Income Your chargeable income is best illustrated with an example like so. While the 28 tax rate for non-residents is a 3 increase from the previous years 25.

15 Tax incentives 16 Exchange controls 20 Setting up a business 21 Principal forms of business entity 22 Regulation of business 23 Accounting filing and auditing requirements 30 Business taxation 31. New Malaysia Personal Income Tax Rates 2016 Assessment Year 2015. On the First 2500.

EGTRRA included a new 10-percent tax rate bracket as well as reductions in tax rates for brackets higher than 15 percent of one-half percentage point for 2001 and 1 percentage point for 2002. 15 Tax incentives 16 Exchange controls 20 Setting up a business 21 Principal forms of business entity 22 Regulation of business 23 Accounting filing and auditing requirements 30 Business taxation 31 Overview 32 Residence 33 Taxable income and rates 34 Capital gains taxation 35 Double taxation relief 36 Anti -avoidance rules 37. Remember two key things.

Calculations RM Rate TaxRM A. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020.

Income Tax Formula Excel University

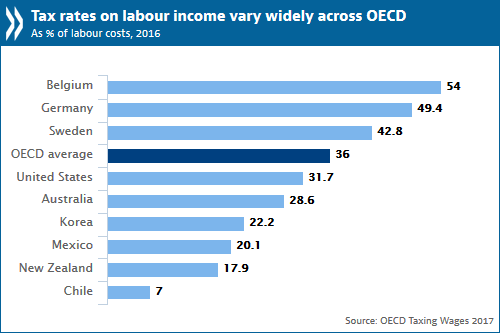

Oecd Tax Rates On Labour Income Continued Decreasing Slowly In 2016 Oecd

How To Create An Income Tax Calculator In Excel Youtube

Irs Announces 2016 Tax Rates Standard Deductions Exemption Amounts And More

How To Calculate Income Tax In Excel

Malaysian Personal Income Tax Pit 1 Asean Business News

The Malaysia Budget 2015 Will Be Announced By Datuk Seri Najib Razak On October 10 2014 At The Parliament This Infographics Sho Budgeting Infographic Malaysia

Income Tax Formula Excel University

How To Calculate Income Tax In Excel

Individual Income Tax In Malaysia For Expatriates

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

Income Tax Formula Excel University

Income Tax Formula Excel University

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)